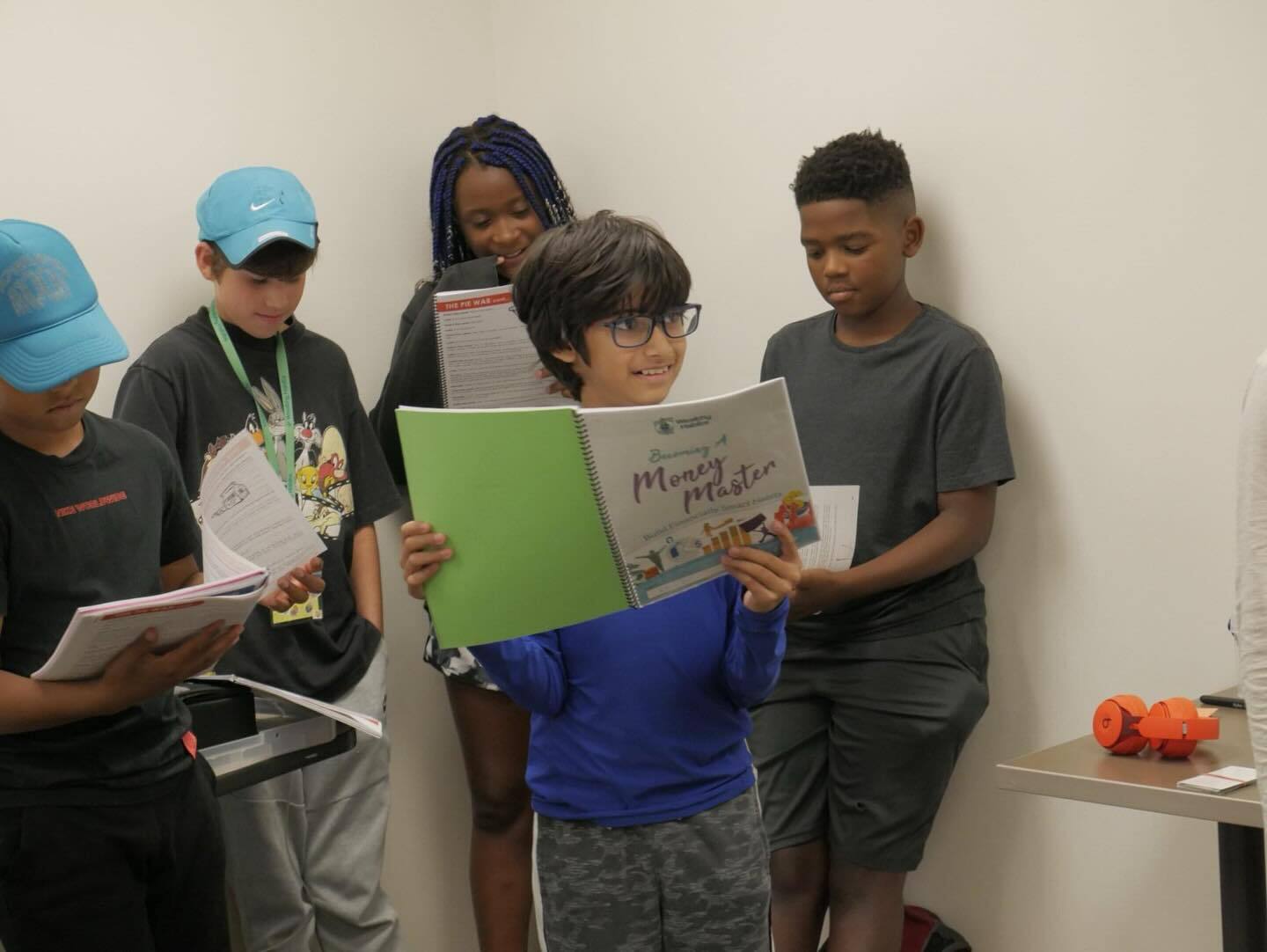

Info about kid camp

| Departure from: | United States |

| Age: | 12–18, Teens (13-17), High Schoolers (15-18), 7th grade (12-13), 8th grade (13-14), 9th grade (14-15), 10th grade (15-16), 11th grade (16-17), 12th grade (17-18) |

| Gender: | Co-Ed |

| Academics: | Finance, L1: Academics, L2: Career |